The Grameen Bank, founded in Bangladesh in 1976, revolutionized the concept of lending and banking for the poor. It pioneered the innovative approach of providing small loans, also known as microcredit, to the impoverished, especially women, who had limited access to traditional financial institutions. This article delves into the remarkable journey of the Grameen Bank, its founder, and the transformative impact it has had on millions of lives worldwide.

The Birth of the Grameen Bank

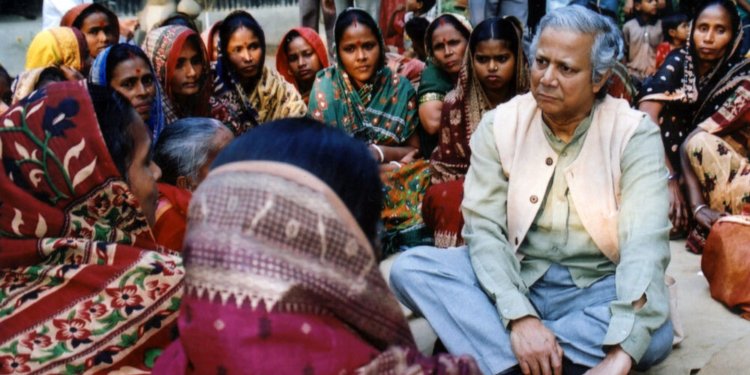

The Grameen Bank was established in the rural village of Jobra, Bangladesh, by Nobel Laureate Muhammad Yunus. Witnessing the rampant poverty and the lack of financial opportunities for the poor, Yunus was inspired to create a bank that would cater specifically to their needs. The primary objective was to eradicate poverty by providing access to credit without the conventional collateral requirements.

The Concept of Microcredit

How Microcredit Works

The cornerstone of Grameen Bank’s success lies in its microcredit model. Instead of lending to individuals, the bank extends credit to groups of individuals with similar economic conditions. These groups, known as “self-help groups” or “solidarity groups,” collectively take responsibility for loan repayments, fostering a sense of community and mutual support.

The Impact of Microcredit on Poverty

Grameen Bank’s microcredit program has proven to be a powerful tool in poverty alleviation. By providing funds for small businesses and income-generating activities, it empowers borrowers to improve their standard of living. The loans enable them to invest in education, healthcare, and housing, breaking the cycle of poverty for future generations.

Grameen Bank’s Founder – Muhammad Yunus

A visionary and a social entrepreneur, Muhammad Yunus believed in the potential of the poor to lift themselves out of poverty. His dedication to the cause earned him the Nobel Peace Prize in 2006, making him the first Bangladeshi to receive this prestigious honor.

Grameen Bank’s Structure and Operations

Group-Based Lending Model

The group-based lending model adopted by Grameen Bank fosters a sense of accountability among borrowers. The social pressure to repay the loans ensures a high repayment rate, making the bank financially sustainable.

Interest Rates and Repayment Terms

Grameen Bank charges interest rates that are higher than traditional banks. Critics argue that this may lead to further indebtedness for the poor. However, the bank’s repayment terms and flexible scheduling take into account the borrowers’ income cycles.

Diversification of Services

Over the years, Grameen Bank has expanded its services beyond microcredit. It now offers insurance, savings programs, and housing loans, addressing various dimensions of poverty.

Success Stories of Grameen Bank Borrowers

The Grameen Bank has countless success stories of individuals who have transformed their lives through microcredit. From setting up small businesses to pursuing higher education, these borrowers have defied the odds and emerged as self-reliant individuals.

Awards and Recognition

The pioneering work of Grameen Bank and its founder, Muhammad Yunus, has been acknowledged globally. The bank has received numerous awards and recognition for its exceptional contribution to poverty alleviation and sustainable development.

Replication of the Grameen Model Worldwide

The Grameen Bank’s successful model has inspired the creation of similar microcredit institutions worldwide. Countries across Asia, Africa, and Latin America have adopted the Grameen approach to empower their own communities.

Criticisms and Controversies

While Grameen Bank has achieved remarkable success, it has not been without its share of criticisms. Some argue that the high-interest rates and aggressive loan recovery methods place undue stress on borrowers, leading to defaults and social issues.

Social Impact and Sustainable Development

Grameen Bank’s innovative model has a broader impact on society. It fosters a sense of social responsibility among borrowers and promotes sustainable development through environmental initiatives and community development projects.

Grameen Bank and Women Empowerment

Grameen Bank recognized the transformative potential of women as borrowers and agents of change. By empowering women economically, it has played a crucial role in enhancing gender equality and women’s participation in decision-making.

Innovations and Future Prospects

The Grameen Bank continues to evolve and innovate its services to adapt to changing times and emerging challenges. Its digital initiatives have further expanded access to financial services for remote and underserved communities.

Grameen Bank’s Role in Crisis Situations

During times of crisis, such as natural disasters or economic downturns, Grameen Bank has played a critical role in providing emergency financial assistance to affected communities.

Collaborations and Partnerships

Grameen Bank’s success is also attributed to its collaborations and partnerships with governments, NGOs, and international organizations. These alliances have strengthened the bank’s outreach and effectiveness.

Conclusion

The Grameen Bank’s journey from a humble beginning to a global force in poverty alleviation demonstrates the power of innovative thinking and social entrepreneurship. Its pioneering microcredit model has empowered millions of impoverished individuals, giving them the tools to break free from the shackles of poverty.