What if the key to unlocking economic prosperity for millions isn’t in complex policies, but in something as simple as a bank account?

Financial inclusion means giving everyone fair chances to use important money tools. These tools help people and businesses grow. They include banking, loans, and insurance products.

This access helps families save and invest. It can reduce income gaps across communities. Many face barriers to these services, despite their clear benefits.

Our guide explores both the bright spots and the hurdles. We look at how to make these services affordable and easy to get. This effort matters for economic growth and equality in the United States and worldwide.

Key Takeaways

- Financial inclusion provides equal access to essential money services for all people and businesses.

- It helps drive economic growth by enabling savings, investments, and insurance.

- Access to these services can reduce income inequality and improve household stability.

- Services covered include banking, loans, equity, and insurance products.

- Affordable and timely access is crucial for true inclusion.

- Both opportunities and challenges exist in expanding financial inclusion globally.

- It has transformative potential for low-income and marginalized groups.

What is Financial Inclusion and Why It Matters

Imagine a world where everyone can save for their children’s education or get a small loan to start a business. This vision drives the concept of broad economic participation through accessible money tools.

Defining Financial Inclusion in Modern Economics

In today’s economy, this concept means all people and businesses can use affordable, responsible money services. These services meet their needs through payments, savings, credit, and insurance.

True empowerment comes from both access and usage. It transforms lives, especially for small businesses and historically underserved groups.

The Critical Role of Financial Services in Economic Participation

Formal money systems help people join the economy fully. They reduce reliance on informal, unregulated tools that often carry high risks.

When individuals can save safely or borrow responsibly, they invest in their futures. This participation drives broader economic growth and stability.

About 1.4 billion adults globally lack a basic account. Even when accounts exist, many remain underused. This gap leaves one in three adults without vital tools for improvement.

Why Financial Inclusion Matters for Social Equity

Access to money services helps bridge economic disparities. It supports the United Nations Sustainable Development Goals by creating more equal opportunities.

Marginalized groups, women, and rural communities historically faced exclusion. Proper services provide practical benefits like agricultural loans or education savings.

Meaningful inclusion requires more than just access. It needs empowerment through usable services that truly meet people’s needs.

The Evolution of Financial Inclusion: A Historical Perspective

Grassroots credit initiatives laid the foundation for today’s broad economic participation efforts. This journey shows how simple ideas grew into global movements.

The path from local lending to worldwide systems reveals important lessons. Each era brought new approaches to serving underserved communities.

Early Concepts and Microcredit Foundations

In the 1970s, microcredit movements began in developing countries. These programs offered small loans to people without traditional collateral.

Pioneers like Muhammad Yunus showed that poor communities could repay loans reliably. This challenged conventional banking wisdom about risk and trust.

Early success stories proved that access to capital could transform lives. Small businesses grew from modest investments in local communities.

Global Recognition and UN Initiatives

The term gained official recognition in the early 2000s. Global institutions like the World Bank connected it to poverty reduction goals.

Former UN Secretary-General Kofi Annan emphasized addressing exclusion barriers in 2003. He highlighted the need for fair participation in money systems.

In 2009, Queen Máxima of the Netherlands became the UN Special Advocate. Her role focused on promoting inclusive finance for development worldwide.

The United Nations defined clear objectives for these efforts. They emphasized access to a full range of affordable services through sound institutions.

These goals now appear in seven Sustainable Development Goals. This shows their importance to global development strategies.

Digital Revolution and Modern Approaches

Technology transformed how people connect with money management tools. Mobile banking and fintech innovations broke down traditional barriers.

Since 2011, over 1.2 billion people gained access to formal services. Digital platforms made this rapid expansion possible across diverse regions.

Modern approaches leverage smartphones and internet connectivity. They offer affordable options that reach remote communities effectively.

These technological solutions build on decades of learning. They combine innovation with lessons from earlier microcredit successes.

The evolution continues as new tools emerge. Each advancement brings us closer to universal economic participation.

Current State of Financial Inclusion Globally

While progress has been made worldwide, significant gaps remain in economic participation. Understanding where we stand today helps identify areas needing urgent attention.

Global Statistics and Unbanked Populations

Recent data reveals 1.4 billion adults lacked basic banking services in 2021. This represents a substantial portion of the global population.

Women and rural poor face the greatest barriers. They often live far from physical banks and lack required documentation.

Low-income groups struggle with minimum balance requirements. Many cannot afford traditional account fees.

Regional Disparities and Progress Metrics

Access levels vary dramatically across different parts of the world. Some regions show remarkable progress while others lag behind.

Romania had 31% of adults without bank accounts in 2021. This contrasts sharply with more inclusive nations.

The World Bank’s Global Findex database tracks these metrics. IMF Financial Access Surveys provide additional insights.

These tools help measure Sustainable Development Goal 8.10. However, they might not capture all aspects of true economic participation.

The United States Context and Specific Challenges

America faces unique obstacles despite its developed economy. Marginalized communities often encounter discriminatory practices.

Predatory lending targets vulnerable populations. Payday loans with high interest rates trap low-income individuals.

Many Americans lack basic money management skills. This knowledge gap exacerbates existing inequalities.

Targeted interventions are needed to address these specific challenges. Custom solutions must consider regional and demographic differences.

Key Benefits of Financial Inclusion for Society

When communities gain proper money tools, remarkable transformations occur. These advantages extend far beyond individual accounts to reshape entire societies.

Research demonstrates powerful connections between accessible services and community well-being. The positive effects ripple through economies and social structures.

Economic Growth and Development Impacts

Bringing people into formal money systems creates powerful economic momentum. New participants become active contributors to local economies.

Small businesses get the capital they need to grow and hire. This creates jobs and boosts productivity across communities.

Entrepreneurship flourishes when people can access startup funds. Local markets expand as more people can participate as both producers and consumers.

The World Bank notes that nations with broader service access show stronger economic performance. This growth becomes more sustainable when more people participate.

Poverty Reduction and Income Equality

Access to savings and credit helps break cycles of poverty. Families can invest in education, housing, and income-generating activities.

Marginalized groups gain opportunities previously out of reach. Wealth gaps narrow as more people build assets over time.

Studies show that proper money management tools help reduce income inequality. When people can save safely, they accumulate resources for future needs.

This progress toward economic fairness strengthens entire communities. It creates more balanced and resilient local economies.

Resilience Building for Vulnerable Communities

Insurance products and emergency savings provide crucial safety nets. Families can weather unexpected medical bills or natural disasters.

Climate resilience improves when farmers can access crop insurance. Food security increases as agricultural communities become more stable.

Women gain greater control over household finances and decisions. This empowerment leads to better education and health outcomes for families.

Communities move away from predatory lending practices. They build long-term stability through formal protection mechanisms.

These advantages create stronger, more self-sufficient societies. The benefits extend across generations through improved opportunities.

Major Barriers to Financial Inclusion

Despite global progress, significant obstacles still prevent millions from accessing essential banking services. These challenges appear on multiple fronts and require comprehensive solutions.

Supply-Side Challenges: Institutional Limitations

Many communities lack physical banking locations. Rural areas often have no branches for miles.

High account maintenance costs deter low-income users. Minimum balance requirements create additional hurdles.

Stringent documentation demands exclude those without formal identification. This affects migrant workers and homeless populations.

Demand-Side Barriers: Consumer Limitations

Low money management skills prevent effective service use. Many lack basic budgeting knowledge.

Cultural distrust of formal banking persists in some communities. Historical discrimination creates lasting skepticism.

Religious beliefs sometimes conflict with conventional banking practices. Some avoid interest-based products entirely.

Regulatory and Infrastructure Obstacles

Outdated legal frameworks hinder innovation. Regulations often fail to support new service models.

Poor internet connectivity limits digital banking access. Remote regions suffer from inadequate infrastructure.

Inadequate consumer protection exposes users to risks. Data privacy concerns discourage service adoption.

Digital literacy gaps create technology barriers. Older adults struggle with mobile banking apps.

Research shows even well-intentioned programs can have unintended consequences. Some microfinance initiatives led to over-indebtedness.

Holistic approaches must address both supply and demand barriers simultaneously. Solutions should consider local contexts and specific community needs.

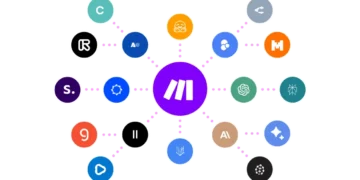

Digital Financial Services: Revolutionizing Access

Technology is rewriting the rules of money management for millions who never had bank access before. Digital tools create new pathways to economic participation that bypass traditional barriers.

These innovations make essential services available through devices people already own. They reach communities where physical banks never established presence.

Mobile Banking and Payment Solutions

Mobile money services transformed access in many developing nations. Kenya’s M-Pesa system became a global success story.

It allows users to send and receive money through basic mobile phones. This approach reached over 80% of Kenyan adults within years.

These solutions work without internet connectivity or smartphones. They use simple SMS technology that even basic phones can handle.

Similar systems emerged across Africa and Asia. They provide safe alternatives to cash for daily transactions.

Fintech Innovations Driving Inclusion

Technology companies develop tailored products for underserved communities. Digital lending platforms assess creditworthiness using alternative data.

These systems analyze mobile phone usage patterns and transaction histories. They offer small loans to people without traditional credit scores.

Insurtech companies create affordable micro-insurance products. Farmers can protect crops against drought using mobile-based policies.

Blockchain technology enables secure cross-border payments at lower costs. Migrant workers can send money home with reduced fees.

Digital Literacy and Adoption Challenges

Many potential users lack skills to navigate digital platforms. Older adults struggle with mobile applications and online interfaces.

Language barriers prevent full utilization in diverse communities. Some platforms don’t offer local language support.

Trust issues persist regarding digital transaction security. People worry about losing money through technical errors or fraud.

Data privacy concerns discourage adoption among cautious users. They fear personal information might be misused or sold.

Biometric authentication enhances security for digital transactions. Fingerprint and facial recognition prevent unauthorized access.

Partnerships between tech companies and traditional banks drive innovation. These collaborations combine technological agility with regulatory experience.

Consumer protection measures build trust in digital systems. Clear dispute resolution processes encourage broader adoption.

Digital solutions complement physical banking infrastructure. They extend reach to remote areas without replacing local options.

Banking Infrastructure and Physical Access Points

Behind every digital transaction lies the need for tangible access points that build trust in money management systems. Physical locations remain essential for communities with limited technology access or digital skills.

These service centers provide face-to-face assistance that many people prefer. They help bridge the gap between traditional and modern banking methods.

Branch Banking in Underserved Areas

Traditional bank branches play a crucial role in rural and low-income neighborhoods. They offer services that require personal interaction and documentation.

Many people need help opening their first accounts or understanding complex products. Physical locations provide this hands-on support that digital platforms cannot replicate.

India demonstrated this by requiring 25% of new branches in unbanked regions. This policy significantly improved access to basic financial services.

Business Correspondent Models

The business correspondent model uses local intermediaries to extend banking reach. These partners include NGOs, companies, and Common Service Center operators.

They act as mini-branches in remote villages and urban neighborhoods. This approach reduces costs while maintaining service quality.

Correspondents handle basic transactions like deposits and withdrawals. They connect communities to formal financial institutions through trusted local faces.

Community Banking Initiatives

Self-help groups (SHGs) have transformed economic participation in many regions. These community-based organizations pool resources and provide mutual support.

They particularly empower women and rural populations. SHGs create pathways to formal banking relationships through collective accounts.

These models build trust through familiar community structures. Members feel more comfortable accessing services through people they know.

Physical access points continue to complement digital solutions. They ensure nobody gets left behind in the move toward online banking.

Maintaining this infrastructure faces challenges like high costs and remote logistics. However, the benefits for economic development justify these investments.

Local banking presence supports broader goals like poverty reduction and community stability. It provides the foundation upon which digital innovations can build.

Financial Products Designed for Inclusion

Innovative money tools are reshaping how underserved communities manage their economic lives. These specialized offerings address unique needs that traditional services often overlook.

They range from simple savings options to protective coverage plans. Each product aims to remove barriers that prevent full economic participation.

Basic Savings and Deposit Accounts

Entry-level banking options help people start their money management journey. India’s no-frills accounts demonstrate this approach effectively.

These accounts require zero minimum balances for opening. They eliminate traditional barriers that kept many from formal banking systems.

Relaxed know-your-customer rules make account creation easier. Small accounts can be opened with minimal documentation requirements.

This approach has brought millions into the formal economy. It provides safe places to save even small amounts of money.

Microcredit and Small Business Lending

Small loans empower entrepreneurs to launch and grow their ventures. These lending products fill gaps left by conventional banks.

They provide capital for business startups and expansions. Many focus on women-owned enterprises and rural businesses.

Responsible lending practices prevent over-indebtedness issues. Clear terms and fair interest rates protect borrowers.

India’s general purpose credit cards offer flexible borrowing options. They help small business owners manage cash flow challenges.

Inclusive Insurance Products

Protective coverage helps vulnerable populations manage unexpected events. These products shield people from financial shocks.

Farmers use crop insurance against weather-related losses. Mobile-based systems make these policies accessible in remote areas.

Kenya’s mobile insurance platforms demonstrate successful implementation. They offer affordable protection through simple technology.

Climate-resilient products address specific environmental risks. They help communities withstand natural disasters and changing conditions.

Regulatory Framework and Policy Initiatives

Supportive rules create environments where inclusive products can thrive. Governments worldwide are implementing helpful policies.

Regulatory sandboxes allow testing of innovative services. They balance consumer protection with innovation support.

These frameworks enable new approaches to reach underserved groups. They help institutions develop better solutions.

The World Bank supports many of these regulatory improvements. Their guidance helps countries create effective systems.

Government Policies Promoting Financial Inclusion

National programs drive large-scale access to essential services. India’s Pradhan Mantri Jan Dhan Yojana shows remarkable success.

This initiative created over 18 million bank accounts. It provided universal access to basic banking services.

Similar programs exist in many developing nations. They combine account access with other support services.

These policies often include financial education components. They help people make the most of newly available services.

Regulatory Sandboxes and Innovation Support

Controlled testing environments allow new ideas to develop safely. Regulatory sandboxes help fintech companies innovate responsibly.

They provide temporary relief from certain regulations. This enables testing of novel products and services.

These sandboxes help identify potential risks early. They ensure consumer protections remain strong during innovation.

The approach has proven successful in multiple countries. It balances progress with necessary safeguards.

Consumer Protection Measures

Strong safeguards prevent exploitation of vulnerable users. Transparency in fees and terms is essential for trust building.

Clear disclosure requirements help people understand costs. Simple language makes complex products easier to comprehend.

Dispute resolution systems address problems quickly. They give users confidence in trying new services.

These protections are especially important for first-time users. They ensure positive experiences with formal financial institutions.

Effective consumer protection builds long-term trust. It encourages continued use of beneficial services.

Technology’s Role in Expanding Financial Access

Cutting-edge technologies offer fresh approaches to reaching those excluded from formal economic systems. These innovations create secure pathways to essential money management tools.

Digital platforms overcome traditional barriers like distance and documentation requirements. They bring vital services to remote areas and underserved communities.

Biometric Authentication Systems

Fingerprint and iris scanning provide secure access for users with limited literacy skills. These systems verify identity without requiring complex passwords or paperwork.

India’s Aadhaar program demonstrates successful implementation at scale. It links biometric data to bank accounts for millions of citizens.

This approach prevents fraud while maintaining ease of use. People can access services through simple biological markers they always carry.

Blockchain and Distributed Ledger Technology

Blockchain creates transparent records for cross-border payments and remittances. It reduces costs by eliminating intermediate processing steps.

Distributed systems increase trust through shared verification processes. Every participant can see transaction histories without central control.

This technology particularly benefits migrant workers sending money home. They save on transfer fees while ensuring funds reach intended recipients.

AI and Machine Learning Applications

Artificial intelligence helps assess credit risk for borrowers without traditional histories. Algorithms analyze alternative data like mobile phone usage patterns.

Machine learning models identify reliable repayment candidates from non-traditional indicators. This expands lending opportunities to previously excluded groups.

These systems continuously improve their accuracy through experience. They adapt to local conditions and emerging patterns.

The Bali Fintech Agenda provides a global framework for responsible innovation. This World Bank and IMF initiative guides technology implementation.

Digital literacy programs ensure users can effectively utilize new tools. Education complements technological advancements for maximum impact.

Data privacy remains a critical consideration in all technology solutions. Proper safeguards prevent misuse while enabling access.

Algorithmic bias must be addressed to avoid excluding vulnerable groups. Regular audits ensure fair treatment for all users.

These technologies support broader goals of reducing service costs and increasing efficiency. They make economic participation more accessible worldwide.

Financial Literacy and Education Programs

Knowledge opens doors to better money management for everyone. Education programs teach people how to use banking tools wisely.

These programs help individuals make smart choices about saving and spending. They build confidence in using modern money systems.

Good education leads to better financial health for families. It helps people avoid common money mistakes and traps.

Community-Based Financial Education

Local programs bring money lessons directly to neighborhoods. They offer free tax help and welfare application assistance.

Non-profit groups often provide coaching in underserved areas. These services work with people where they live and work.

Community programs understand local needs and cultural backgrounds. They create trust through personal connections.

Many adults learn better in familiar community settings. This approach makes education more relevant and effective.

School Curriculum Integration

Schools help young people build money skills early. California’s AB-423 bill adds financial lessons to grade 9 classes.

Students learn about budgeting, saving, and basic investing. These skills prepare them for real-world money decisions.

Early education creates lifelong good habits. It helps future consumers navigate complex financial products services.

Schools across many countries now include money management. This education supports broader economic growth goals.

Digital Financial Literacy Initiatives

Online banking requires new skills and awareness. Digital programs teach safe use of mobile payments and apps.

Users learn to protect themselves from fraud and scams. They understand how to manage accounts securely online.

These initiatives help people access financial services confidently. They reduce fears about technology-based systems.

Gamified learning makes digital education engaging. Mobile tutorials reach people through devices they use daily.

Financial institutions support these learning efforts. They want customers to use their services safely and effectively.

Good digital skills help households avoid online risks. They enable full participation in modern banking systems.

Education programs make financial inclusion efforts more successful. They ensure people benefit from available services.

Both public and private sectors fund these important initiatives. Their investment creates more financially capable communities.

Case Studies: Successful Financial Inclusion Models

Real-world success stories show how innovative approaches can transform economic participation. These examples from different continents demonstrate what works in practice.

Each model addresses unique local challenges through tailored solutions. They provide valuable lessons for other regions seeking similar progress.

India’s Jan Dhan Yojana Program

India launched the Pradhan Mantri Jan Dhan Yojana in 2014. This ambitious program aimed to bring unbanked populations into the formal system.

It created over 18 million basic bank accounts with minimal requirements. These accounts offered zero balance options and relaxed documentation rules.

The initiative significantly expanded access to essential services across the country. It particularly reached rural communities and low-income households.

Some accounts showed low activity after opening. Ongoing efforts focus on increasing usage through education and product improvements.

Kenyan Mobile Money Success Story

Kenya’s M-Pesa system revolutionized money management through mobile technology. It allowed users to send and receive funds using basic phones.

The service reached over 80% of Kenyan adults within years of launch. It provided safe alternatives to cash transactions in areas without banks.

Digital literacy gaps initially limited adoption among some groups. Continuous education efforts have helped more people benefit from the system.

This model demonstrates technology’s power to scale access rapidly. It has inspired similar mobile money solutions across Africa and beyond.

European Basic Payment Account Directive

The European Union introduced the Payment Account Directive in 2014. This policy ensures all residents can open basic payment accounts.

It specifically protects vulnerable groups and legally resident migrants. Member states must provide access to essential banking services.

Implementation challenges vary across different countries. Some nations struggle with consistent application of the rules.

The directive represents a regional commitment to economic participation. It shows how policy frameworks can support broader inclusion goals.

These case studies highlight common success factors. Strong government support and technological innovation drive progress.

Public-private partnerships have been crucial in each model. They combine resources and expertise for greater impact.

Lessons from these examples can guide efforts in other parts of the world. Context-specific approaches work best for local needs and conditions.

Ongoing improvements focus on enhancing consumer protection and expanding product offerings. These efforts ensure sustainable progress toward full economic participation.

Private Sector Involvement and Partnerships

Businesses are stepping up to help more people join the money system. Companies across different industries now see the value in reaching underserved communities. Their efforts complement government programs and create lasting change.

Private organizations bring innovation and resources to this important work. They develop new products and services that meet specific needs. Their involvement helps scale solutions that might otherwise remain small.

Banking Industry Initiatives

Traditional banks are creating special accounts with low fees. These products help individuals who couldn’t afford regular banking before. Many institutions have removed minimum balance requirements.

Banks are also expanding their physical presence in rural areas. They use mobile branches and local agents to reach remote communities. These efforts bring essential services closer to people who need them most.

Some institutions partner with retail stores to offer basic banking. Customers can deposit and withdraw money at familiar locations. This approach makes access more convenient for working families.

Fintech Company Contributions

Technology firms are developing mobile apps for money management. These digital tools work on basic smartphones that many people already own. They provide safe alternatives to cash transactions.

Innovative lending platforms use alternative data for credit decisions. They look at payment history for utilities and mobile phones. This helps consumers without traditional credit scores get loans.

Digital wallets allow instant money transfers between users. They’re particularly helpful for migrant workers sending funds home. These systems reduce costs compared to traditional transfer services.

Corporate Social Responsibility Programs

Many companies fund education programs about money matters. These initiatives teach basic budgeting and saving skills. They often work through local community organizations.

Some corporations support microfinance institutions with grants and loans. This funding helps small lenders serve more entrepreneurs. These partnerships create opportunities for small business growth.

Other programs focus on specific groups like women or youth. They provide tailored products and training for these audiences. This targeted approach addresses unique barriers different communities face.

Successful models often involve multiple partners working together. Banks might provide accounts while telecom companies offer mobile platforms. NGOs frequently deliver education and support services.

These collaborations combine different strengths and resources. They create comprehensive solutions that no single organization could achieve alone. The World Bank supports many such partnerships globally.

Challenges include balancing social goals with business needs. Companies must ensure their efforts remain sustainable over time. Responsible practices prevent harm to vulnerable consumers.

Global initiatives like UN partnerships show what’s possible. Private sector involvement continues to evolve and expand. Future trends may include impact investing and climate-focused products.

These efforts contribute to broader economic growth and stability. They help households improve their financial health and security. Ultimately, they create more inclusive systems that benefit everyone.

Future Trends in Financial Inclusion

The horizon of money management is expanding with technologies that could redefine how communities interact with economic systems. These emerging approaches combine digital innovation with environmental awareness to create more accessible pathways.

Central Bank Digital Currencies (CBDCs)

National digital currencies represent a significant evolution in payment systems. CBDCs offer government-backed digital money that operates alongside traditional cash.

These digital currencies provide secure, low-cost payment options for everyone. They reduce dependence on private payment providers and increase system stability.

Many countries are exploring CBDC implementations through pilot programs. The digital euro and other proposals show how national digital currencies might work in practice.

CBDCs could particularly benefit people who lack access to traditional banking services. They offer a public option for digital payments that doesn’t require commercial bank accounts.

Open Banking and Data Sharing

Open banking frameworks allow consumers to control and share their financial information securely. This approach enables third-party developers to create innovative applications.

Customers can permission access to their banking data for personalized services. This leads to better financial products tailored to individual needs and circumstances.

Data sharing must balance innovation with privacy protection. Strong regulations ensure that personal information remains secure while enabling useful services.

Emerging markets are implementing open banking initiatives with careful safeguards. These programs demonstrate how data sharing can expand economic opportunities responsibly.

Climate Finance and Green Inclusion

Environmental challenges are creating new approaches to economic participation. Climate-focused financial products help communities adapt to changing environmental conditions.

Farmers can access insurance against weather-related crop losses. These protective products provide security against climate uncertainty and natural disasters.

Green inclusion efforts support a just transition to sustainable economies. They ensure that environmental benefits reach all community members equally.

Climate resilience products represent an important expansion of traditional financial offerings. They address both economic and environmental challenges simultaneously.

These emerging trends face implementation challenges that require thoughtful solutions. Digital divides may limit access for some population groups without proper support.

Regulatory frameworks must evolve to protect consumers while encouraging innovation. Policymakers play a crucial role in ensuring these new approaches benefit everyone.

Inclusive design principles help ensure that technological advances serve diverse needs. Solutions must work for people with varying levels of digital literacy and access.

The World Bank supports many of these developments through research and guidance. Their work helps countries implement these trends effectively and equitably.

These innovations contribute to broader sustainable development goals worldwide. They represent the continuing evolution of how societies approach economic participation and environmental responsibility.

Conclusion: The Path Forward for Financial Inclusion

Creating equal access to money tools remains a global priority. The journey requires overcoming barriers through technology and smart partnerships.

Digital solutions help reach remote communities effectively. They must work alongside physical access points for complete coverage.

Consumer protection ensures safe participation for all users. Education programs build confidence in using modern services.

Future efforts should connect with climate and gender goals. This integrated approach maximizes positive impact worldwide.

Continued innovation and local adaptation will drive progress. Together, we can build systems that serve everyone fairly.

FAQ

What does financial inclusion mean?

It refers to efforts that give individuals and businesses useful and affordable access to products and services. These offerings meet their needs and are delivered responsibly and sustainably.

Why is expanding access to services important?

Broadening availability helps reduce poverty, supports economic growth, and empowers people. It allows households to manage cash flow, invest in opportunities, and withstand financial shocks.

How many people globally lack a bank account?

According to the World Bank, around 1.7 billion adults remain unbanked worldwide. Many are in developing economies, though challenges also exist in developed nations like the United States.

What are common barriers preventing access?

Key obstacles include high costs, distance to providers, lack of documentation, and low trust in institutions. Limited knowledge about products also plays a significant role.

How is technology improving availability?

Mobile banking, digital payments, and fintech apps are making it easier and cheaper to reach underserved groups. These tools help overcome traditional infrastructure and cost barriers.

What role do governments play in promoting inclusion?

Public authorities create supportive policies, regulate providers, and sometimes directly offer services. They also back financial education and consumer protection efforts.

Can improved access help during health or climate crises?

Yes. Digital transfer systems enable quick aid distribution. Insurance and savings options also help households manage risks from emergencies or environmental changes.