What if you could measure social and environmental change with the same precision as financial returns?

This question challenges investors who want to make a real difference. Many struggle to quantify their positive impact beyond dollars and cents.

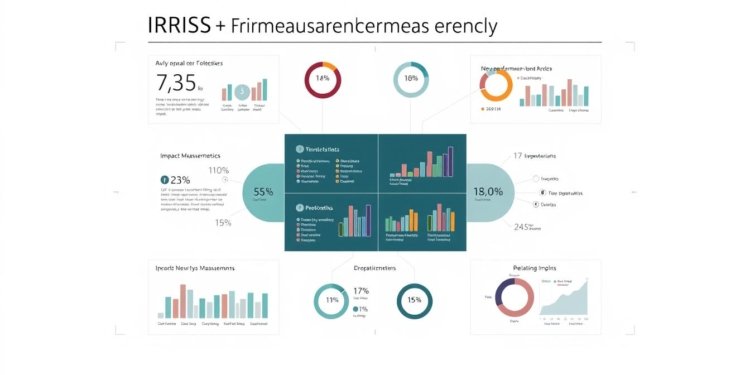

The IRIS+ system provides clear answers. It offers standardized metrics for measuring social and environmental results.

This framework helps investors align their portfolios with global goals like the Sustainable Development Goals. It turns vague intentions into measurable outcomes.

Developed by the Global Impact Investing Network, IRIS+ serves as a free public resource. It provides essential guidance for making smarter investment decisions.

This article explores how this powerful tool works. You’ll learn to implement it for better financial and social returns.

Key Takeaways

- IRIS+ provides a standardized system for measuring social and environmental impact

- Investors can achieve both financial returns and positive social change

- The framework offers clear metrics that enhance decision-making processes

- It aligns investments with global standards like the Sustainable Development Goals

- IRIS+ is available as a free resource developed by impact investing experts

- The system helps transform good intentions into measurable results

- Proper implementation leads to more transparent and effective impact reporting

Understanding the IRIS+ Framework for Impact Measurement

How do investors measure real-world change beyond financial statements? The answer lies in a standardized approach to impact measurement.

This framework provides clarity where ambiguity once existed. It transforms subjective assessments into quantifiable data points.

What Are IRIS+ Indicators?

These metrics serve as universal measurement tools. They track social, environmental, and financial performance across investments.

Standardized metrics create consistency in reporting. Investors can compare results across different portfolios and time periods.

The system offers clear benchmarks for success. This enables precise tracking of progress toward stated objectives.

The Development and Purpose of IRIS+ by GIIN

The Global Impact Investing Network created this comprehensive system. They designed it as a free public resource for all investors.

Its primary purpose is establishing a common language. This allows impact investors to communicate results effectively.

Standardized data facilitates meaningful comparisons. Investors can benchmark their performance against industry standards.

The framework supports evidence-based decision making. This leads to optimized resource allocation and better outcomes.

How IRIS+ Complements Sustainable Development Goals

The framework directly aligns with global development goals. It maps specific metrics to UN Sustainable Development targets.

This alignment creates powerful synergies. Investments can contribute directly to broader development objectives.

Using iris metrics helps track progress toward these goals. Investors see how their capital advances specific development outcomes.

The system integrates data from authoritative sources. This includes information from the World Bank and UN databases.

Practical benefits emerge from this integration. Investors achieve measurable social and environmental returns alongside financial gains.

Key Components and Features of IRIS+ System

What separates a truly effective impact measurement system from basic reporting tools? The answer lies in its structural components and integrated features.

This framework combines multiple elements into a cohesive whole. Each component serves a distinct purpose in the measurement process.

Thematic Taxonomy for Systematic Impact Classification

The system organizes impact areas into logical categories. This taxonomy helps investors navigate complex social and environmental challenges.

Classification follows clear thematic structures. Investors can quickly identify relevant areas for their portfolio focus.

This systematic approach drives positive outcomes through organized action. It creates pathways for targeted investment strategies.

Core Metric Sets for Standardized Measurement

Standardized lists of metrics form the foundation of consistent reporting. These sets increase data clarity across different investment portfolios.

Each core set follows industry best practices. They address five key dimensions: what changes, who benefits, how much change occurs, contribution level, and risk factors.

This structure enables meaningful comparisons between investments. Investors benchmark performance against established standards.

Catalog of Metrics for Comprehensive Performance Tracking

A comprehensive repository contains both qualitative and quantitative metrics. Leading impact investors use this catalog for thorough performance tracking.

The collection includes standardized measurement tools for various impact areas. Investors can select existing metrics or add custom ones for specific needs.

This flexibility supports tailored impact assessment strategies. It accommodates unique investment goals while maintaining data integrity.

Alignment with Major Frameworks and Standards

The system integrates seamlessly with over 50 established frameworks. This includes alignment with UN Sustainable Development Goals and other global standards.

Interoperability extends to third-party data platforms. This enhances utility throughout the impact measurement and management process.

Investors benefit from this comprehensive integration. They can work across multiple systems while maintaining consistent data standards.

Implementing IRIS+ Indicators in Investment Decision-Making

How can investors transform impact data into actionable intelligence? The answer lies in systematic implementation of standardized metrics.

This process turns raw numbers into strategic insights. It bridges the gap between data collection and informed decision-making.

The Methodological Approach to Impact Performance Benchmarking

The Global Impact Investing Network follows the COMPASS methodology. This structured approach ensures consistent impact assessment across portfolios.

It begins with defining specific decision needs. Investors identify what information matters most for their strategy.

Next comes collecting standardized impact data. Using IRIS+ metrics ensures apples-to-apples comparisons across different investments.

Analysis follows with key performance indicators. These KPIs measure progress against stated objectives.

Finally, insights get applied through dynamic dashboards. This completes the cycle from data to decisions.

Analytic Figures: Scale, Pace, and Investment-Weighted Results

Three core analytic figures drive meaningful assessment. Each serves a distinct purpose in performance evaluation.

Investment-Weighted results normalize impact by capital deployed. This shows efficiency per dollar invested.

Scale measures year-on-year volume change. It quantifies the magnitude of impact created.

Pace tracks percentage change over time. This indicates acceleration or deceleration of progress.

Together, these figures provide a comprehensive performance picture. They help investors understand both quantity and quality of impact.

Practical Application in Financial Inclusion Investments

Consider financial inclusion as a concrete example. Investors measure outcomes like increased account ownership.

Data comes from multiple sources for context. This includes investor reports and third-party sources like Findex.

The World Bank provides additional benchmarking data. This external context helps validate internal findings.

Normalization handles outliers using interquartile range methods. This ensures data quality and reliability.

Investors can then compare their performance against peer groups. They can also measure progress toward SDG targets.

Data Collection and Standardization Processes

Effective data collection follows rigorous protocols. Standardization ensures consistency across different sources.

The process involves careful contextualization of results. External data sources provide valuable comparison points.

Normalization ratios adjust for different investment sizes. This allows fair comparison between large and small portfolios.

Statistical methods like IQR handle outlier data points. This maintains data integrity throughout the analysis.

Continuous refinement improves data quality over time. As the benchmark grows, analytics become more sophisticated and reliable.

Conclusion: Leveraging IRIS+ for Enhanced Impact Outcomes

How do we turn investment intentions into measurable change? The answer lies in standardized measurement frameworks.

This powerful system enables precise impact tracking. Investors gain clear insights into social and environmental results.

The framework maintains strong alignment with global standards. It supports better investment decisions through comparable data sets.

Ongoing refinements ensure continued relevance. The system evolves to address emerging challenges and opportunities.

Investors can incorporate additional metrics alongside core measurements. This flexibility enhances internal management while maintaining standardization.

Adopting this approach creates meaningful outcomes for people and planet. It transforms capital into measurable positive change.

Explore these resources to enhance your impact strategy. Start measuring what truly matters today.

FAQ

What is the IRIS+ system and who created it?

The IRIS+ system is a set of widely accepted tools for measuring social and environmental performance. It was developed by the Global Impact Investing Network (GIIN) to provide a common language for impact investors. This helps people track and compare results across different investments.

How does IRIS+ relate to the Sustainable Development Goals?

IRIS+ aligns directly with the Sustainable Development Goals (SDGs). It provides specific metrics that help investors measure progress toward these global goals. This alignment ensures that investments contribute to broader development targets.

What are Core Metric Sets in IRIS+?

Core Metric Sets are pre-defined groups of metrics for specific themes or sectors. They offer a standardized way to measure performance in areas like financial inclusion or clean energy. Investors use these sets to simplify their reporting and benchmarking processes.

How can investors implement IRIS+ in their decision-making?

Investors can use IRIS+ throughout the investment lifecycle. They select relevant metrics during due diligence, track performance during management, and report outcomes. The system provides clear guidance for data collection and analysis to support informed choices.

Does IRIS+ work with other impact frameworks?

Yes, IRIS+ is designed to align with major global frameworks and standards. This allows investors to use it alongside other tools without duplication. The system promotes harmony across different measurement approaches.