More than $2 billion has been crowdfunded to support over five million entrepreneurs worldwide. That scale shows how technology and empathy can reshape access to capital for low-income communities.

Born in Ahmedabad and raised in Minnesota, this Indian-American entrepreneur combined academic research, fintech experience, and a bold prototype to build a global microlending platform. His work linked everyday lenders with small-business owners in 62+ countries.

The nonprofit he co-founded sustained a 96% repayment rate and focused lending—about 81% to women and significant support for rural areas. These metrics point to a model that is both inclusive and resilient.

In this article, we trace the journey from Stanford and the London School of Economics to PayPal and the fieldwork that launched person-to-person microlending at scale. We also summarize later leadership roles and honors that reflect long-term influence across tech and social impact.

Key Takeaways

- Kiva scaled person-to-person microlending to a global audience.

- Over $2 billion in loans reached millions with a 96% repayment rate.

- The model prioritized women and rural entrepreneurs for inclusive impact.

- Early fintech experience and field prototyping were crucial to success.

- Later board roles and awards show continued leadership in social tech.

- This story links data-driven impact with a clear mission for financial inclusion.

From Microfinance Vision to Global Reach: An Overview of Shah’s Mission-Driven Work

A simple idea—connect everyday lenders with entrepreneurs who lack bank access—grew into a global platform for microloans. That concept launched a nonprofit in 2005 that has since focused on expanding financial access to the unbanked.

Kiva’s purpose and origins in expanding access to finance for the unbanked

The platform was born from microfinance research at Stanford and a 2004 sabbatical to prototype person-to-person lending in India. Co-founders, including Matt Flannery and Jessica Jackley, turned those experiments into a live marketplace.

The model channels small-dollar loans through vetted partners, using storytelling and transparency to attract individual lenders. Its aim is inclusion: funding microenterprises, often led by women or people in rural areas.

By the numbers: since 2005 the organization has disbursed over $2 billion with a 96% repayment rate while directing a large share of loans to women and rural borrowers. Operations span many countries, showing how modest contributions add up to broad impact.

Premal Shah

Growing up across two continents inspired a focus on applied research and products that widen access to capital.

Early life and education

Born in Ahmedabad in 1975 and raised in Minnesota, he graduated from Irondale High School before studying economic development at Stanford. A London School of Economics research grant funded field work with SEWA, giving direct insight into how small loans help informal workers.

PayPal years and a defining sabbatical

As a principal product manager at PayPal, he learned to scale financial products. A 2004 sabbatical to India produced a working prototype of person-to-person microlending that proved demand and usability.

Co-founding Kiva and later leadership

In 2005 he joined Matt Flannery and Jessica Jackley to launch Kiva. The nonprofit has raised over $2 billion, mobilized more than two million lenders, supported over five million entrepreneurs in 62 countries, and sustained a 96% repayment rate with strong outreach to women and rural borrowers.

Beyond Kiva

He transitioned from Kiva president to senior advisor, led Branch International as president, and co-founded Renewables.org in 2021. Board roles at the Center for Humane Technology, Change.org Foundation, Watsi, and VolunteerMatch reflect a commitment to ethical tech and civic impact. Honors include Fortune 40 Under 40, White House Champion of Change, WEF Young Global Leader, and the 2024 Carnegie Corporation Great Immigrants award.

Impact by the Numbers: Entrepreneurs, Countries, and a Remarkable Repayment Rate

Concrete numbers reveal the scope and performance of a people-powered lending platform.

Over $2 billion crowdfunded to support millions worldwide

More than $2 billion in crowdfunded loans has reached over five million entrepreneurs through a global network of partners. That cumulative lending shows how many small contributions can unlock real capital for micro and small businesses.

A 96% repayment performance and strong focus on women and rural communities

The repayment rate sits around 96%, indicating high loan performance when intermediaries vet and support borrowers. About 81% of loans go to women, and roughly two-thirds have targeted rural borrowers, underscoring an inclusion-first approach.

Two million-plus lenders and reach across dozens to over a hundred countries

More than two million individual lenders have participated, signaling broad trust in transparency and impact reporting. Reported country coverage has ranged from 62 to as many as 150 countries, reflecting partnerships that manage diverse legal and economic environments.

Together, these metrics point to scalable, measurable outcomes: strong repayment fundamentals, gender-forward lending, and geographically diversified support for entrepreneurs ready to grow.

Conclusion

A career that moved from academic research to product leadership shows how disciplined design can scale financial tools for underserved communities.

The co-founder of Kiva launched a peer-to-peer microlending model in 2005 that has mobilized over $2 billion, reached entrepreneurs across dozens of countries, and sustained a 96% repayment rate. The platform kept a strong focus on women and rural borrowers while expanding geographic reach.

Later roles in digital finance and climate investing, plus board service with civic and health groups, underscore a lasting commitment to financial inclusion. The honors earned reflect both personal leadership and proof that measured, mission-driven innovation can unlock capital for small businesses worldwide.

FAQ

Who is Premal Shah and what are his main achievements?

Premal Shah is a social entrepreneur and co-founder of Kiva, a pioneering person-to-person microlending platform. He helped scale Kiva from an idea into a global nonprofit that has crowdfunded over billion to support millions of entrepreneurs across dozens of countries. Shah has also led initiatives at Branch International, co-founded Renewables.org, and served on boards including the Center for Humane Technology, Change.org Foundation, Watsi, and VolunteerMatch.

What inspired Shah to start Kiva?

While at PayPal and during a sabbatical, Shah explored ways to extend financial access to people without traditional banking. That experience, combined with early research at Stanford and LSE influences, seeded the idea of person-to-person microlending. Kiva launched to connect individual lenders with entrepreneurs in underserved communities, making small loans that could be repaid and recycled.

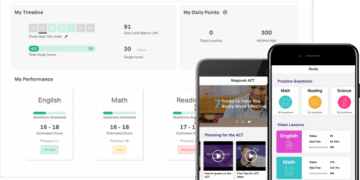

How does Kiva work and what was its original purpose?

Kiva’s purpose is to expand access to finance for the unbanked by matching individual lenders with vetted borrowers via local field partners. Lenders choose entrepreneurs or projects to fund, and when loans are repaid, they can relend, withdraw, or support new borrowers. The model leverages crowdfunding and partner networks to reach rural and underserved populations.

How many entrepreneurs and countries has Kiva or Shah’s efforts supported?

Shah’s work with Kiva and affiliated initiatives helped channel over billion to support millions of entrepreneurs in roughly 60 to 150 countries, depending on how programs and partner networks are counted. The platform prioritized strong rural outreach and programs tailored to local needs.

What repayment rate has Kiva achieved and what does that mean?

Kiva has reported a high repayment rate, commonly cited around 96%. This indicates that most borrowers repay loans, enabling lenders to recycle funds and sustain impact. High repayment reflects careful partner screening, borrower accountability, and diversified loan portfolios.

How much of the lending supports women and rural communities?

Approximately eight in 10 loans facilitated through Kiva-supported channels have gone to women. The platform also emphasized strong rural outreach, directing capital to small-scale entrepreneurs, farmers, and local businesses that often lack access to formal banking.

Who are the lenders and how many participate in these platforms?

More than two million individual lenders have used Kiva and related crowdfunding channels to support inclusive finance. These lenders come from diverse backgrounds and countries, ranging from casual supporters to sustained impact investors.

What roles has Shah taken beyond Kiva?

After leading Kiva, Shah moved into roles that expanded financial inclusion and ethical technology. He led efforts at Branch International, co-founded Renewables.org to accelerate clean energy, and served on notable boards including the Center for Humane Technology, Change.org Foundation, Watsi, and VolunteerMatch to advance social impact and responsible tech.

How do Kiva’s outcomes get measured?

Outcomes are tracked through repayment statistics, numbers of borrowers served, geographic reach, and demographic metrics such as gender and rural versus urban recipients. Kiva and partner organizations also collect qualitative impact stories and program evaluations to measure economic and social benefits.

Can individuals still lend through Kiva today?

Yes. Individuals can create accounts on Kiva’s platform, browse borrower profiles, select loans to fund, and follow repayment progress. Lenders can reinvest repaid funds or support new borrowers, maintaining ongoing engagement with inclusive finance.

How does Kiva ensure funds reach legitimate borrowers?

Kiva works with vetted local field partners—microfinance institutions, NGOs, and social enterprises—that assess borrowers, disburse loans, and monitor repayment. These partners conduct due diligence, verify identities, and provide support services to reduce risk and improve outcomes.

What is the broader significance of Shah’s work for global poverty alleviation?

Shah’s leadership helped mainstream person-to-person microlending as a tool for financial inclusion. By connecting individual lenders to micro-entrepreneurs, his work demonstrated scalable, measurable ways to expand access to capital, empower women, and stimulate local economies, influencing both nonprofit and fintech approaches to poverty reduction.