For organizations dedicated to social good, finding a financial partner can be a challenge. Many feel their values don’t align with traditional banking models.

This is where a specialized institution like the charity bank makes a difference. It is built specifically for nonprofits and charities. The core idea is to provide financial services that support, not hinder, your charitable work.

This type of bank understands the unique cash flow and operational needs of mission-driven groups. It offers a full spectrum of products, from specialized lending programs to savings options.

The most significant advantage is how deposits are used. Your money is reinvested to fund other social purpose organizations. This creates a powerful cycle of community support.

Choosing to open an account here means your finances directly contribute to positive change. It’s a strategic decision for any group committed to its values.

Key Takeaways

- A specialized financial partner understands the unique needs of mission-driven organizations.

- Services are designed to support, not compromise, your social goals.

- Deposits are reinvested to fund other community-focused initiatives.

- Offers a full range of products tailored for the nonprofit sector.

- Provides a values-aligned alternative to conventional financial institutions.

- Choosing the right partner is a strategic step toward greater impact.

Introduction to Mission-Driven Banking

A revolutionary approach to banking began taking shape over two decades ago, focusing exclusively on mission-driven entities. This model prioritizes social good above profit maximization.

Our History and Background

The institution launched in 2002 with a clear purpose: to serve charities and social enterprises. Its founding principle ensured deposited funds would never support harmful industries or climate chaos.

This unique governance structure involves ownership by charitable foundations and social purpose organizations. Profit generation remains secondary to supporting meaningful work.

Commitment to Social Impact

Transparency defines the organization’s operations. Account holders always know how their deposits create positive community change.

The institution has built trust among people seeking values-aligned financial partners. Every decision reinforces the core mission of amplifying social impact.

Choosing this financial partner means joining a movement where resources actively support community development. It demonstrates that banking can harmonize mission and money effectively.

Why Charity Bank Stands Out

The distinguishing factor for this mission-aligned partner lies in its rigorous certifications and global ethical alliances. These credentials demonstrate a commitment that goes beyond typical financial services.

Core Values and Ethical Practices

Complete transparency defines every aspect of operations. Organisations receive clear explanations about lending decisions and how deposits create positive impact.

Environmental policies ensure funds never support industries harming the planet. This ethical framework extends to all investment choices and daily practices.

B Corporation and Global Alliances

The institution holds B Corporation certification, verifying its commitment to people and planet alongside profit. This status places it among businesses meeting the highest social and environmental standards.

Membership in the Global Alliance on Banking Values connects the organization with like-minded financial institutions worldwide. These partnerships reinforce its purpose-driven approach to services.

These distinguishing features make it the preferred choice for mission-driven groups. The alignment between values and financial operations creates meaningful community impact.

Comprehensive Banking Services for Nonprofits

Nonprofit operations present specific financial challenges that conventional banking often fails to address effectively. Irregular income streams and grant-dependent funding cycles require specialized financial services.

This institution provides comprehensive solutions designed specifically for mission-driven entities. The approach recognizes that every social purpose organisation has unique financial needs.

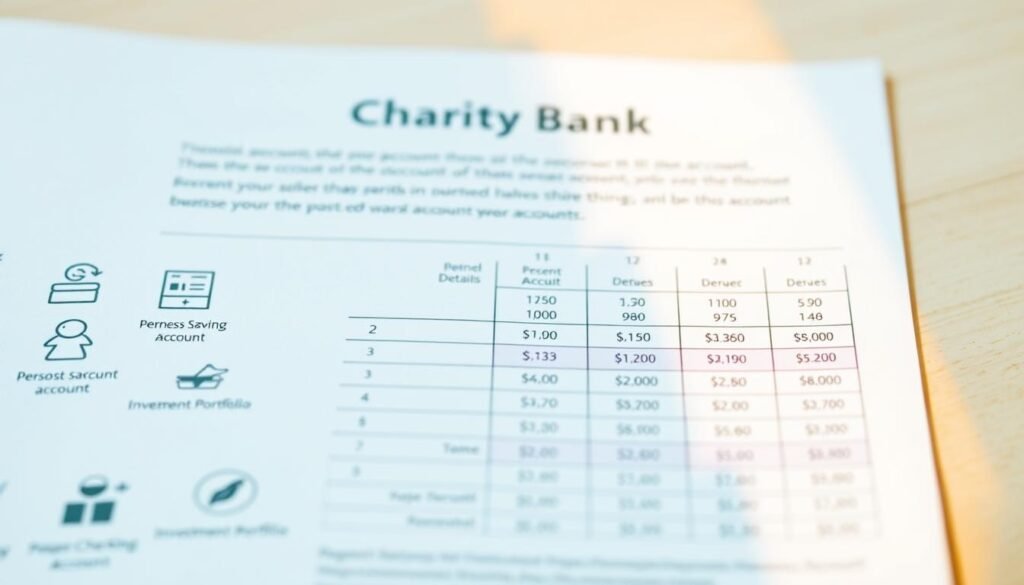

Personal and Nonprofit Account Offerings

Individuals can choose from various account options that align with their values. Traditional savings accounts allow personal funds to support community development.

ISA products offer tax-efficient saving while contributing to charitable causes. These personal accounts provide meaningful financial participation in social impact work.

For charitable organisations, specialized account services accommodate irregular cash flow patterns. Features support grant management and restricted fund tracking effectively.

Customized Lending Solutions

Lending programs focus exclusively on projects with clear social benefits. Loans are available to charities and social enterprises pursuing community improvement.

Each lending solution receives personalized attention from relationship managers. These professionals understand the nonprofit sector’s unique financial landscape.

The institution emphasizes partnership over transactional relationships. This approach ensures financial services truly support organizational missions and community impact.

Ethical Lending and Community Impact

When capital deployment serves community development as its primary objective, the entire lending process transforms. Ethical practices ensure every financing decision considers social benefit alongside financial viability.

Transparent Interest Rates and Fees

Clear communication about costs builds trust with mission-driven organizations. The institution maintains straightforward pricing structures for all lending products.

Interest rates remain competitive while acknowledging the budget constraints of nonprofit borrowers. These rates may vary based on loan size and organizational circumstances.

Fee structures receive full disclosure before any commitment. Account services carry fees that reflect the complexity of services utilized rather than hidden charges.

Support for Charities and Social Enterprises

Regional managers provide personalized assistance to organizations seeking financing solutions. They take time to understand each group’s unique mission and funding requirements.

This support continues beyond the initial lending approval. Relationship managers maintain contact to ensure financing arrangements adapt to evolving organizational needs.

The approach ensures social enterprises receive both capital and strategic guidance. This maximizes both financial sustainability and community impact for every charity served.

Tailored Financial Solutions for Social Enterprises

Social enterprises operate at the intersection of business innovation and community impact. They demand financial partners who grasp this unique dynamic.

These organizations blend revenue generation with social mission. Traditional lenders often misunderstand their hybrid approach to operations.

Partnering with Social Purpose Organizations

The institution’s ownership structure creates natural alignment with mission-driven ventures. Being owned by charitable foundations ensures deep understanding of social purpose.

Lending decisions prioritize the social benefit being created. Conventional financial metrics take a secondary role to community impact assessment.

This approach provides patient capital and flexible arrangements that growing ventures need. Relationship managers develop long-term partnerships rather than transactional interactions.

Financial solutions adapt to different organizational models. Community interest companies and cooperatives receive customized support for their specific needs.

The institution has developed specialized expertise in evaluating purpose-driven business models. This positions it as the premier partner for organizations proving business can drive positive change.

Understanding Account Options and Fee Structures

Financial clarity is essential for mission-driven organizations managing limited resources. The right account setup can significantly impact operational efficiency and budget management.

Feature-Rich Account Types

Various account options cater to different organizational needs. Savings products offer competitive returns while supporting social lending initiatives.

ISA accounts provide tax advantages for individuals connected to social purpose work. These personal choices reflect commitment to values-aligned financial practices.

Specialized features help manage restricted funds and grant allocations effectively. The system accommodates irregular cash flow patterns common in nonprofit operations.

Managing Variable Rates and Costs

Transparent fee structures ensure no surprises for budget-conscious organizations. Costs are proportional to services used, respecting limited administrative resources.

Variable rates on savings products remain competitive with market conditions. Detailed schedules provided during application help with accurate financial planning.

Modern online tools offer convenience while maintaining personalized service. Relationship managers help identify the optimal combination of features for specific needs.

This approach ensures financial services support rather than burden mission-driven work. The right account setup becomes a strategic asset for organizational success.

Innovative Loan Offerings for Your Mission

Access to capital remains one of the most significant barriers facing mission-driven organizations today. The right financing can transform ambitious community projects into tangible realities.

Loan Capabilities and Funding Limits

Organizations can secure substantial funding with loans reaching up to £3.25 million. This level of capital supports major initiatives like property acquisition and program expansion.

When projects require even greater resources, the institution partners with other social lenders. This collaboration ensures important community work proceeds without financial limitations.

Competitive Interest and Lending Benefits

Regional managers provide personalized guidance throughout the application process. They help each customer structure optimal financing arrangements.

The approach prioritizes social value over maximum financial returns. Competitive interest rates reflect this commitment to supporting rather than profiting from charitable work.

Flexible repayment terms accommodate unique cash flow patterns. This includes seasonal variations and grant payment schedules common in nonprofit operations.

Transparent pricing ensures customers understand all costs upfront. The lending philosophy recognizes that investing in social infrastructure generates community impact beyond financial metrics.

Conclusion

Selecting a financial partner represents one of the most strategic decisions for any social purpose organization. The right institution aligns completely with your mission while providing comprehensive services.

This specialized financial partner demonstrates that banking can prioritize social impact without sacrificing service quality. Their unique ownership structure and ethical certifications provide assurance that money works exclusively for community good.

Organizations receive personalized support from relationship teams who understand their specific challenges. Whether establishing accounts or securing loans, customers benefit from transparent fees and competitive rates.

The institution’s track record since 2002 shows sustained commitment to serving mission-driven entities. Choosing this partner ensures your financial resources actively support, rather than contradict, your social goals.

For charities and social enterprises seeking values-aligned banking, this represents the ideal solution. It combines full-service capabilities with genuine commitment to community impact.

FAQ

What types of organisations can open an account?

Our accounts are designed for registered charities, community groups, and social enterprises. We serve organisations dedicated to creating positive change.

How does your lending support the community?

Every loan we provide goes to projects with a clear social purpose. Your money directly funds initiatives that benefit people and the environment.

Are your interest rates competitive for nonprofits?

A>Yes, we offer transparent and fair rates tailored for the nonprofit sector. Our goal is to support your mission, not maximize our profit.

What fees are associated with your accounts?

We keep our fees simple and low. You can find a full breakdown of any monthly or transaction costs on our website.

Can social enterprises apply for funding?

Absolutely. We provide customized lending solutions specifically for social purpose organisations seeking to grow their impact.

What is the maximum loan amount available?

Our lending capabilities are flexible. We discuss funding limits based on your project’s needs and financial health.